If the cost of mortgages has held you back from buying your own home, good news could be on the way. The Bank of England is expected to take action that will lower the cost of mortgages next month. Meanwhile, a slew of well-known high street lenders have started to chip away at their mortgage rates in anticipation of the Bank’s decision.

Over the last three years we’ve seen mortgage costs steadily rising as the government grappled with rising inflation.

First-time buyers (FTBs) and homeowners on fixed-term mortgages with deals coming to an end have been in the firing line. Many FTBs are still holding on, waiting to see what will happen before they take that all-important step towards home ownership.

Once more, our Wanstead Estate agents have combined forces with our estate agents in Ilford to bring you the latest expert opinion on the post election mortgage market.

Is inflation still affecting mortgage rates?

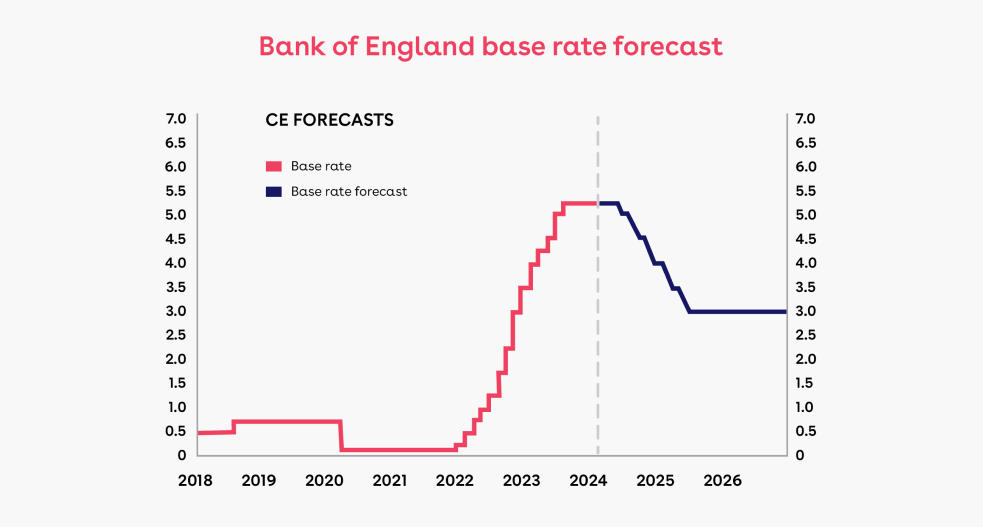

It’s believed that the Bank of England (BoE) will cut the base rate—which is linked to the cost of mortgages—next month. The base rate was raised to tackle inflation, which has risen steadily since 2021. Inflation figures have now dropped from over 11 per cent in 2022 to around two per cent, which is the Bank’s target figure.

The rate currently stands at 5.25 per cent, and it is widely predicted that the BoE will make a cut in August. Economists have forecast that it could go down to 4.5 per cent by year-end.

The rate currently stands at 5.25 per cent, and it is widely predicted that the BoE will make a cut in August. Economists have forecast that it could go down to 4.5 per cent by year-end.

If the BoE does decide to cut the base rate, their decision should lead to cheaper mortgages. So it’s advisable to keep up to date with any changes in the mortgage market.

What’s the outlook for mortgages?

Following the recent general election, we have a new government in place. A change of government often inspires a more optimistic and confident national outlook, and it seems that mortgage lenders have caught this new spirit of optimism.

Even before the Bank of England has cut the base rate, many major banks and building societies have opted to ease the cost of fixed rate mortgages. Lenders are also offering more products for buyers with smaller deposits of five or ten per cent.

The improved availability of lower deposit mortgage products could be the green light many first time buyers have been waiting for. But it’s worth remembering that the smaller your deposit, the higher your mortgage rate will be.

There are many different types of mortgage available, so if you are unsure which product would be right for you, it’s advisable to contact a mortgage broker.

Will house prices go up or down?

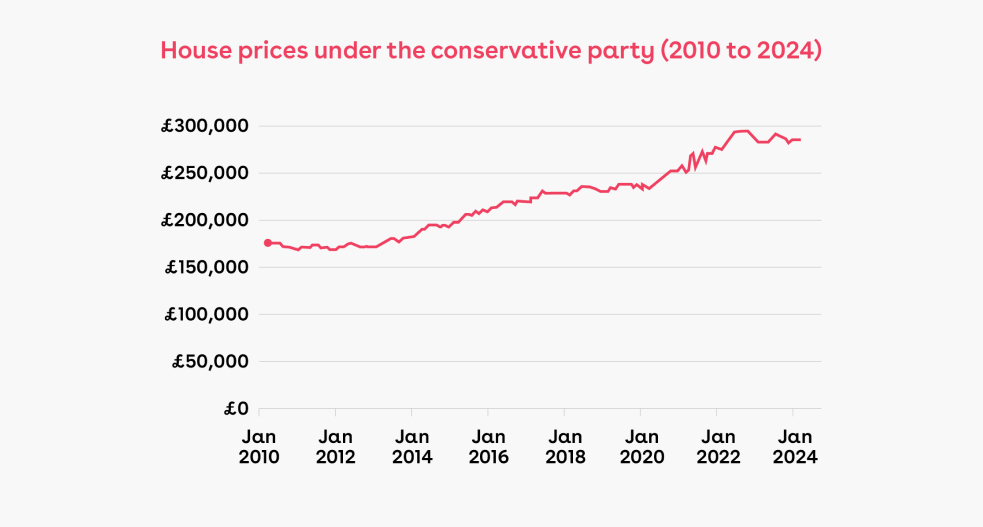

The UK housing market has remained sluggish this year. Depending upon your location, house prices have either flatlined, fallen slightly or risen by a few percentage points. However, experts suggest a cut in the base rate could provide a boost to property values. Zoopla has said that it expects sales numbers will shoot up by as much as 10 per cent if the rate goes down.

It’s possible that this predicted boost will combine with a post-election bounce in property sales, pushing property prices up even further. After analysing the last seven elections, the website This is Money found that prices rose by one per cent in the year after each election.

Can we expect a Stamp Duty hike?

Homebuyers should be aware that prices could start to edge up over the next few months. They will also face a drop in the Stamp Duty threshold next year, making it more expensive to buy a property.

The relaxation of Stamp Duty thresholds was a temporary measure introduced in 2022. At that time, PM Rishi Sunak raised the level at which Stamp Duty becomes payable for first-time buyers from £300,000 to £425,000.

However, the new Labour government has said that when the fixed term ends in April 2025, it will allow the threshold to return to £300,000. Currently, first-time buyers can also claim relief on properties costing up to £625,000, but this will return to the previous level of £500,000.

For other buyers, the nil rate threshold (currently £250,000) will revert to the previous level of £125,000.

Should I buy now?

There are three major points for buyers to consider: a mortgage rate cut is expected in August, a house price bounce could be on the way and Stamp Duty costs will increase next year.

This makes July the ideal month to start your property search, so why not contact a mortgage advisor to find out what deals are available?

If you would like help to find your ideal new home in areas such as Ilford, Wanstead, Newbury Park Barkingside or Gants Hill, we’d love to hear from you. We have a fantastic portfolio of properties for sale, so get in touch and let us know what you are looking for.

Give us a call at 0203 972 7341 or email info@oaklandestates.co.uk.

Properties for sale in Ilford and Barkingside

Properties to rent in Ilford and Barkingside

Don’t forget to follow our socials for the latest property market advice and listings:

https://www.facebook.com/Oakland-Estates-1426149597689066/?fref=ts